Story Highlights

- Customers are shopping for high-quality conversations with bankers

- Three behaviors separate high-quality from low-quality conversations

- Coaching is essential to having high-quality conversations at scale

While the word "sales" continues to have a negative connotation in retail banking -- and is under continued scrutiny by the CFPB -- the reality is that banking leaders aspire to grow, and the most efficient path to growth is to sell new products and services to existing customers.

The opportunity for bankers today is to focus on the person behind the customer, specifically by having needs-based, future-focused conversations with customers that lead to higher sales conversion. Fortunately for bankers, this isn't a one-sided affair. Customers are interested in having these person-centric conversations as well -- but regardless of who starts the conversation, it better be a high-quality one.

Gallup's 2021 Retail Banking Study showed that when a customer has a high-quality conversation with a banker compared with a low-quality one, a sales conversion is 1.6 times as likely if the customer initiated the conversation. And when a customer engages in a high-quality conversation with a banker rather than a low-quality one, a sales conversion is an incredible 4.2 times as likely if the employee initiated that conversation.

This means customers are shopping for conversation quality as much as they are shopping for products, services, rates and features, whether they know it or not. Conversation quality is a huge differentiator among financial institutions that may otherwise offer similar products and services.

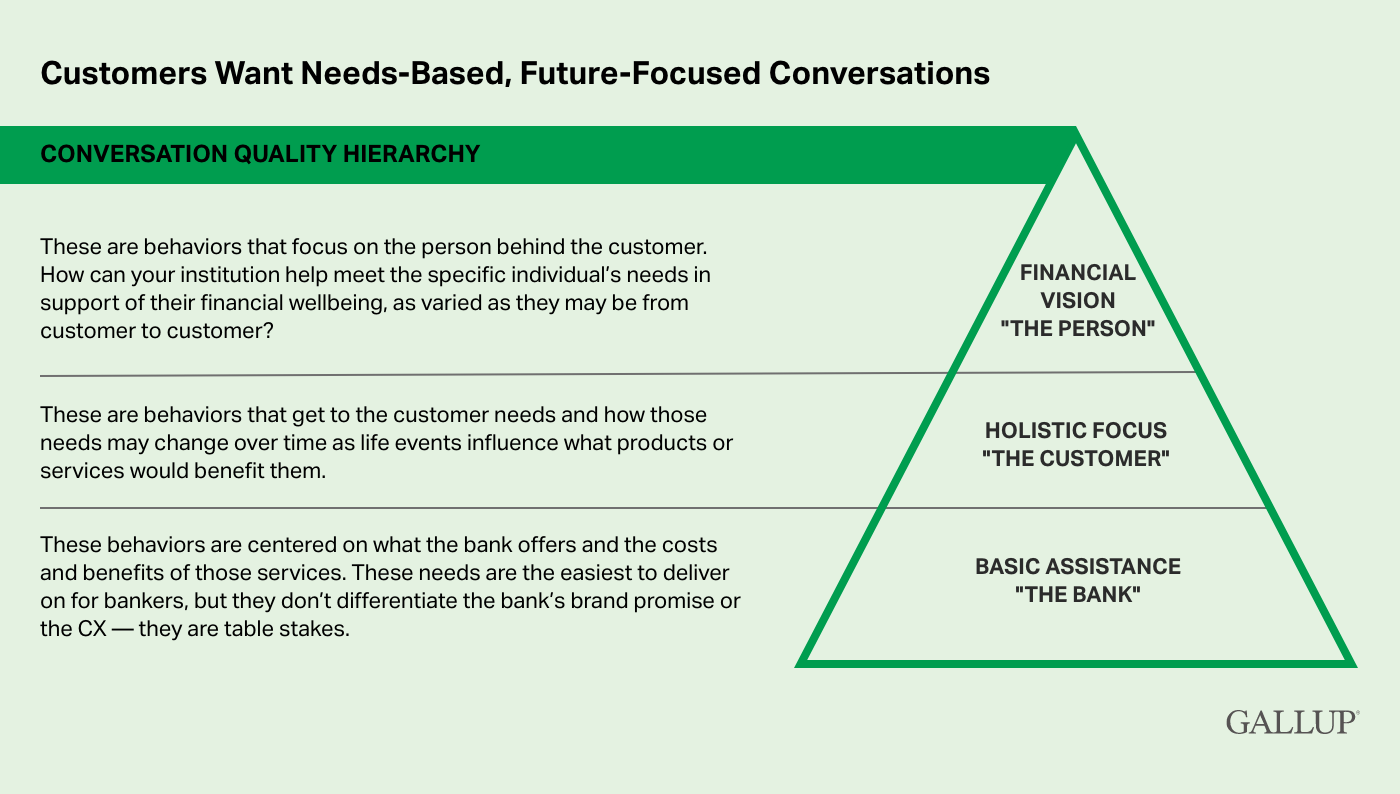

So, what makes a conversation high-quality? Gallup's research and experience working with financial institutions indicate that customers want needs-based, future-focused conversations. Specifically, Gallup experts have identified three banker behaviors that differentiate between a high- and low-quality conversation. The three behaviors are organized in a hierarchy of needs.

Graphic titled "Customers Want Needs-Based, Future-Focused Conversations" that displays the conversation quality hierarchy, represented by a triangle separated into three sections. At the base of the triangle is basic assistance or "the bank." Behaviors that fall into this category are centered on what the bank offers and the costs and benefits of those services. These needs are the easiest to deliver on for bankers, but they don't differentiate the bank's brand promise or the CX -- they are table stakes.

The middle of the triangle is a holistic focus or a focus on "the customer." Behaviors that fall into this category address customer needs and how those needs may change over time as life events influence what products or services would benefit them.

At the top of the hierarchy is financial vision or "the person." Behaviors that fall into this category focus on the person behind the customer. How can an institution help meet the specific individual's needs in support of their financial wellbeing, as varied as it may be from customer to customer.

Bankers meeting any of these needs in any section of the hierarchy increases sales, but it's the top of the hierarchy where the lift in sales is largest. Conversely, bankers typically perform better at the bottom of the hierarchy than at the top. Therein lies the opportunity.

Customers are shopping for conversation quality as much as they are shopping for products, services, rates and features, whether they know it or not.

Despite knowing what behaviors differentiate the quality of these conversations, Gallup finds that high-quality customer conversations are mostly random and happen by chance. These conversations are predicated on the personality and individual approach of the given banker rather than on anything the organization is doing to drive them.

Essentially, banks face a challenge in that 42% of all conversations happening daily are considered net-negative and 47% are considered just average, no matter what initiatives or tools the organization has deployed to try to improve conversation quality.

Banks do not have a quality conversation problem per se versus a quality conversation problem at scale.

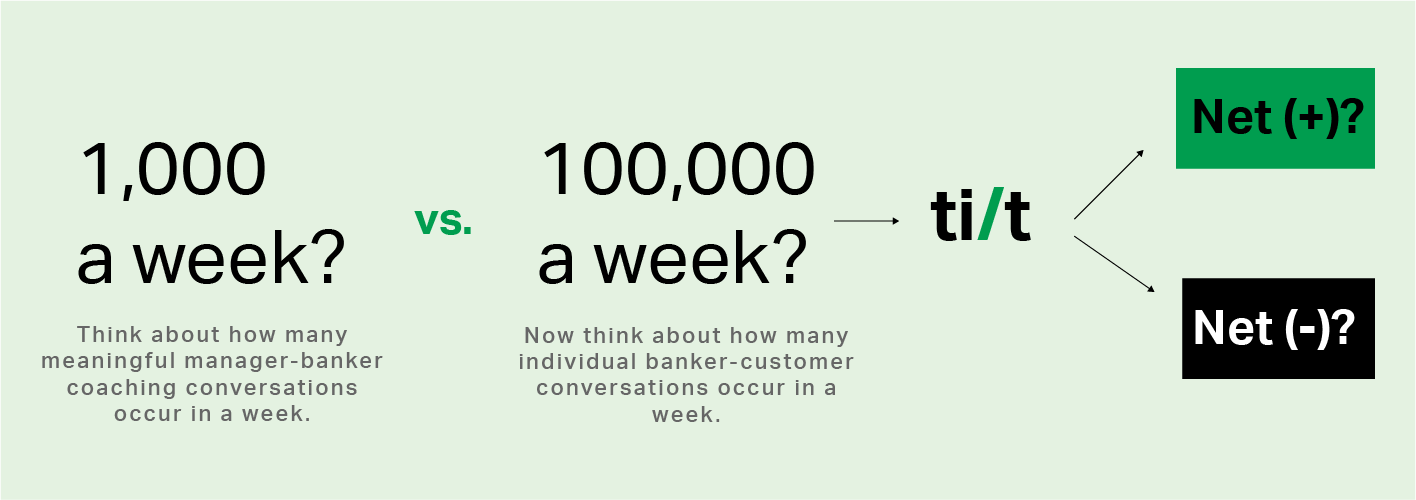

The question for leaders, then, is: How do you make the math of moments "tilt" to the point where most conversations that occur are above-average quality? And importantly, how do you do this quickly to achieve sales goals? In a word, coaching -- Gallup finds that managers who have more meaningful conversations with employees more frequently achieve higher conversation quality.

Consider the average midsized financial institution. Think about how many meaningful manager-banker coaching conversations occur in a week. Now think about how many individual banker-customer conversations happen in a week -- a hundred times as many? This is why average to below-average conversation quality and attempts are so pervasive. Banks simply do not have the math of moments to tilt (or skew) conversation quality positively at scale.

Visual that poses these questions: Think about how many meaningful manager-banker coaching conversations occur in a week - maybe 1,000 a week? Versus, now, think about how many individual banker-customer conversations occur in a week - maybe 100,000 a week? This is what leads to Gallup calls "Tilt," which is when these conversations can either tilt net positive or net negative from a sales conversion perspective.

Financial institutions attempting to shift conversation quality to tilt positive face three common challenges that must be acknowledged and formally addressed to achieve success:

- underwhelming and infrequent coaching attempts

- natural hardwiring of branch managers and bankers

- bridging the "knowing-doing gap" to take action

Common Challenge No. 1: Underwhelming and Infrequent Coaching Attempts

Gallup has identified that highly effective coaching drives conversation quality. When managers provide weekly meaningful feedback, employees are 3.2x more likely to strongly agree they are motivated to do outstanding work and 3.5x more likely to be engaged at work.

Yet, despite all the initiatives financial institutions have put in place over the years to build managers' coaching capabilities, most employees aren't receiving meaningful coaching on a regular basis.

A 2022 Gallup Panel study found that only two in 10 employees say they had received meaningful feedback in the past week. This shortcoming points to a key flaw in the way most banks operationalize coaching -- coaching is almost always framed around the employee experience and life cycle (sporadic and event-focused) rather than the customer experience (a daily occurrence). This approach fundamentally limits coaching frequency to be just a tiny fraction compared with the number of customer conversations occurring, thus limiting the opportunity to achieve positive tilt.

By intentionally providing workers with weekly meaningful feedback centered on the customer experience, managers can start to positively influence the math of moments.

Common Challenge No. 2: Natural Hardwiring of Branch Managers and Bankers

In looking at more than 12,000 banker and branch manager talent profiles across varying financial institutions for the 2022 Strengths Intensity: Branch Managers and Bankers Study, Gallup finds more commonality in the talents of people hired for these roles than differences.

Specifically, Gallup knows that each person has natural ways of thinking, feeling and behaving. The type of individual hired to be a branch manager is not necessarily the type who is naturally talented at coaching. The data, along with our experience, suggest that branch managers are more task-focused than people-focused -- meaning branch managers are typically more wired for and comfortable with managing the work (process managers) than the employee doing the work (people managers).

Coaching is almost always framed around the employee experience and life cycle (sporadic and event-focused) rather than the customer experience (a daily occurrence).

Additionally, many branch managers bring a positive outlook and are naturally agreeable. This can create an inclusive and team-focused work environment, but it can also result in avoiding tough coaching conversations that are important for accountability and performance. As such, the likelihood that branch managers will instigate performance coaching of their own volition is low.

Given all of this, financial institutions need to develop, beyond training and tools, coaching as an operating discipline. For most organizations, this looks like ensuring that coaching and actions are clearly connected, ensuring coaching conversations are triggered by something (like customer experience feedback), and establishing a structure and process for workers to follow around these efforts.

Common Challenge No. 3: Bridging the Knowing-Doing Gap to Take Action

So, we know now that most branch managers aren't currently coaching their workers in a meaningful way, nor are they naturally inclined to do so frequently. But we also know that most managers have experienced manager development programs, want to be better coaches and even understand the importance of it.

The dissonance between those truths is an opportunity -- what Gallup calls bridging the knowing-doing gap. Managers know better but don't necessarily do better. It's human nature; most people know they should eat a well-balanced diet and exercise to feel their best but simply don't. It's not necessarily a conscious decision so much as a lack of prioritization and action.

Beyond their natural inclinations, managers also face a "blank page effect," where coaching attempts lack substantive content, are low-relevance and are latent with bias. It's no wonder managers resist coaching even if they know they need to do it.

But when managers (and employees) are able to commit to deliberate practice, regular feedback in real time, and time to reflect on the feedback, progress is made. More specifically, the manager is coaching from a position of context versus the paralyzing "blank page effect."

This graphic displays the concept that coaching with regular feedback and reflection multiplied by investment of time practicing and building new skills equals a positive tilt of delivering consistent, quality customer conversations.

Gallup can help enable coaching with context to enculturate the right behaviors that will grow meaningful customer conversations and achieve positive tilt.

If leaders are willing to commit the resources and put in the effort, achieving positive tilt can take your organization from random, unpredictable pockets of success to scaled sales success.

Learn more about partnering with Gallup to increase sales effectiveness through enabling the operating discipline of high-quality customer conversations at scale.

- Contact a Gallup expert today.

- Discover how we help financial services firms create organic growth.

- Sign up to get financial services insights sent right to your inbox.