Story Highlights

- Customer satisfaction has been on the decline since 2019

- The CEO's hardest job over the next 10 to 20 years will be growth

- 70% of the variance in team engagement is determined by the manager

The following is adapted from Culture Shock, Gallup’s new book about the biggest leadership challenge of our time. For more insights, order your copy of Culture Shock today.

The pandemic brought an awakening that shocked the world -- a structural change in how humans work and live. Nothing is going back to normal. This is a moment of evolutionary change.

How we adapt to this culture shock will determine whether U.S. and global productivity will go up or down.

The danger is that a majority of employees will now operate more like independent contractors or gig workers than employees who are loyal and committed to your organization and customers. The risk grows as your workforce’s mindset continues to shift from “my life at work” to “my life at home.”

Leaders are asking Gallup, “How do we bring employees back?” The bigger issue is customer retention. The American Customer Satisfaction Index reported declines in customer satisfaction with U.S. companies starting in 2019, with steep drops in 2020 through 2022. Employees are also now less likely to say that their organization delivers on its promise to customers.

Customers are quietly quitting.

Simply put, your employees and customers know each other. Many are best friends. All the good stuff that holds big accounts together is at risk.

Executives and thought leaders are asking Gallup as their workplaces lose energy: “Can you please tell me, as specifically as possible, the role that relationships and feelings play in keeping customers and driving financial outcomes?”

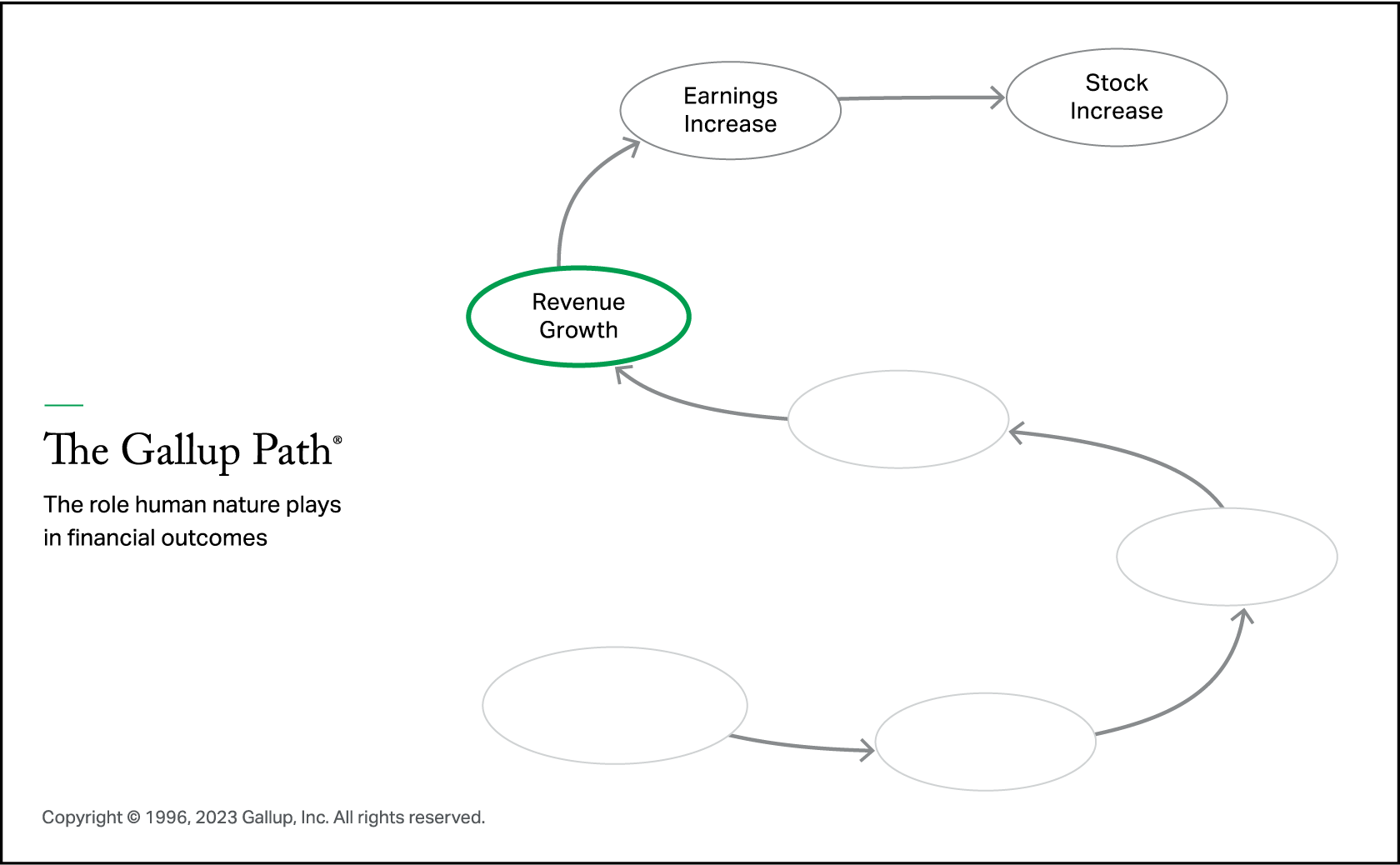

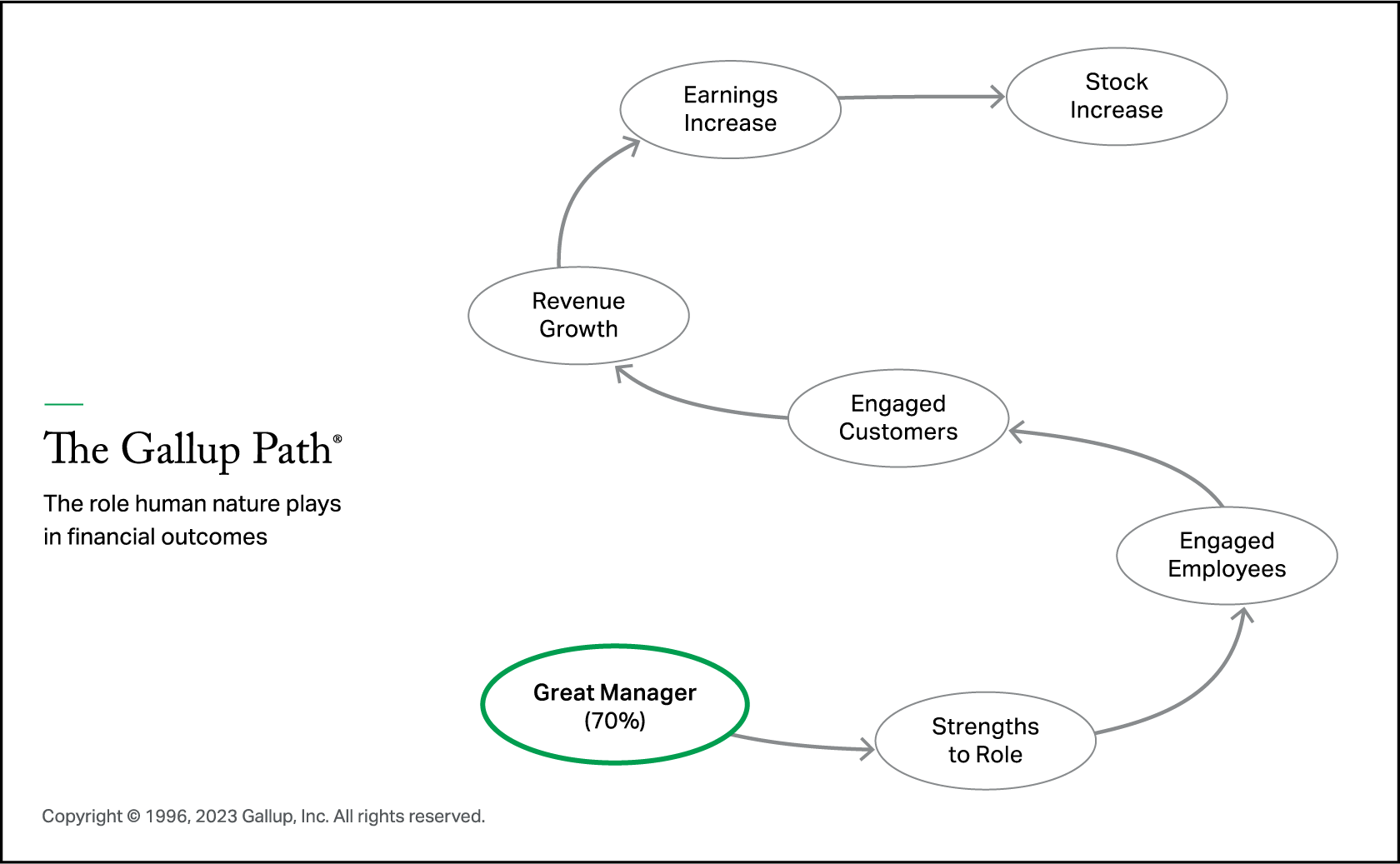

We did that. It’s called The Gallup Path -- a quarter century of global meta-analytics on one page, in one picture. It is our conclusion of how behavioral economics -- feelings and emotions -- retains customers and drives revenue growth, earnings and stock price.

Let’s start here: As you already know, the best predictor of stock increase has always been earnings increase. This is where CEOs spend most of their time.

There are other factors that impact stock price, such as acquisitions, buybacks, a leadership change the media likes and new product announcements. But the one that best correlates year over year and decade over decade is simply earnings increase. Increased/decreased earnings explain almost all the variation in stock prices, controlling for market fluctuations.

The surest way to increase earnings is to cut costs. CEOs and executive committees work on that most of the time -- reducing costs or driving down supplier prices and payroll. Management consultants are primarily cost cutters. These are all good things and what most CEOs are best at.

Cost cutting works, but after a while, it hits a wall. At some point, companies have to grow their customer base. These are two separate leadership activities -- and both are absolute requirements for running any kind of organization well.

Cost cutting works, but after a while, it hits a wall. At some point, companies have to grow their customer base.

Let’s call cost cutting the defense and creating customers the offense. The Gallup Path drives the offense.

What most predictably drives earnings increase? Revenue growth.

Revenue growth begins with keeping the customers you have. Customer retention is the most critical metric on a CEO’s dashboard. Building out customers is the second most important. And third is acquiring new customers. As we noted earlier, U.S. customer satisfaction is in decline. Losing customers is the new biggest risk created by the culture shock.

The best growth comes from keeping and nurturing the customers you have. CEOs know this, but it’s hard to remember.

The CEO's hardest job over the next 10 to 20 years will be growth.

Let’s keep going.

Revenue growth is the best predictor of real earnings increase. The top three bubbles on The Gallup Path are what you learn to use in MBA classes and consulting training. They are the classic business economics of the last 100 years.

So, what predictably moves revenue growth across all industries?

Customer engagement. A feeling from your customers that you are an essential partner who adds value to their life and business. That is behavioral economics at its purest -- where feelings become facts.

When your customers feel that you add value and care about their success, they buy more, transact more frequently, are less price sensitive and are more likely to recommend. Engaged customers are typically 25% of your customer base.

The next question is: What is the primary driver of customer engagement? Our scientists dove deep into our world’s largest data pool -- with meta-analytics across more than 100,000 business units -- to find out.

Your engaged employees create your engaged customers. When your employees are quietly quitting, the customers feel it and they begin quietly quitting.

Your engaged employees create your engaged customers. When your employees are quietly quitting, the customers feel it and they begin quietly quitting.

Customer-employee interactions move the sales needle, up or down, more than any other single factor. This is where declining employee engagement impacts your customer centricity.

Here is a bit of customer survey engineering: On a scale of 1 to 5 with 5 being high (strongly agree), the single most important futuristic metric is percentage of 5s on customer engagement (likely to recommend) -- 5s predict success, 4s don’t. The percentage of 5s on customer engagement is the best way for a CEO to evaluate overall future corporate performance.

When an organization improves its number of 5 ratings from 25% to 35%, sales rise, profit increases and stock prices go up. If there is a silver bullet for leading revenue growth, it is boosting this customer engagement score.

This is why a winning culture for any type of organization is one of relentless customer focus.

Several years ago at a Business Roundtable event in Colorado Springs, Jeff Bezos approached me with his hand extended. Rather than introduce himself or say, “Hi Jim,” he said, “Have you tried Prime?” He didn’t want to know how I thought the conference was going. He didn’t want to know about Gallup. He wanted to know if I and the other people standing around had tried his new product, Prime. How customer intense is this guy?

Imagine that heightened level of customer intensity in all companies.

Increasing employee engagement shoots human energy through customers -- and predictably, you have revenue growth, increased earnings and finally -- increased stock price.

So how do you increase employee engagement? A crucial breakthrough is this: Fitting individual strengths to every role is essential to winning in business, science, education, sports or anything. If you stumble here, nothing else matters.

Peter Drucker said, “Few people, even highly successful people, can answer the questions: Do you know what you’re good at? Do you know what you need to learn so that you get the full benefit of your strengths?”

Drucker also said, “The task of leadership is to create an alignment of strengths in ways that make weaknesses irrelevant.” Fitting strengths to role is one of the biggest game breakers Gallup has ever discovered.

Some managers and coaches have natural instincts to “fit” someone’s strengths to a role; others can learn and greatly improve at it. Any manager can learn how to fit strengths to role as a competency.

Gallup’s biggest global workplace discovery ever is that a staggering 70% of the variance in team engagement -- hence productivity -- is determined by just the manager. So go your managers, so goes everything. Few CEOs, board members or investors know that.

The quality of the manager is the lowest hanging fruit for booming customer success and real revenue growth and earnings increase. The most predictable lever in your entire organization to drive the power of behavioral economics is the manager.

What differentiates a great manager from an average one? The shortest answer is that they are experts at putting people in roles that use their natural strengths. The second and last thing they do differently is coach versus administrate. Administrating teams is important and necessary, but every person in every role needs a masterful coach to help them grow and develop.

The most predictable lever in your entire organization to drive the power of behavioral economics is the manager.

There it is. The Gallup Path is the best explanation of behavioral economic linkages beginning with the manager all the way to stock increase.

Gallup is recommending that all clients conduct a one-time audit of the current state of their culture -- as well as what culture they want for the next 10 to 20 years. Next, create a new behavioral economics dashboard. And finally, double down on manager reskilling that emphasizes leading strengths-based teams -- require certification of all managers for the new hybrid world.