Story Highlights

- There is no middle ground for engagement in the mortgage experience

- Customers expect excellence -- they don't care about your challenges

- Staffing up with mediocre talent hurts short- and long-term performance

Mortgage lenders are experiencing remarkably high origination volume -- the biggest quarter in 14 years. Gallup Analytics shows that in times like these, mortgage lenders can easily fall prey to two traps:

- explicitly or implicitly sacrificing the customer experience to move loans through the pipeline

- staffing up with average or below-average talent -- B- or C-level talent -- instead of building their business with A-level talent

Trap 1: Sacrificing the mortgage experience.

A customer's mortgage experience is likely the most relationship-defining moment they will ever have with a bank or lender. The mortgage process changes people: Customers walk away either completely in love with you -- or with complete disdain. There is no middle ground.

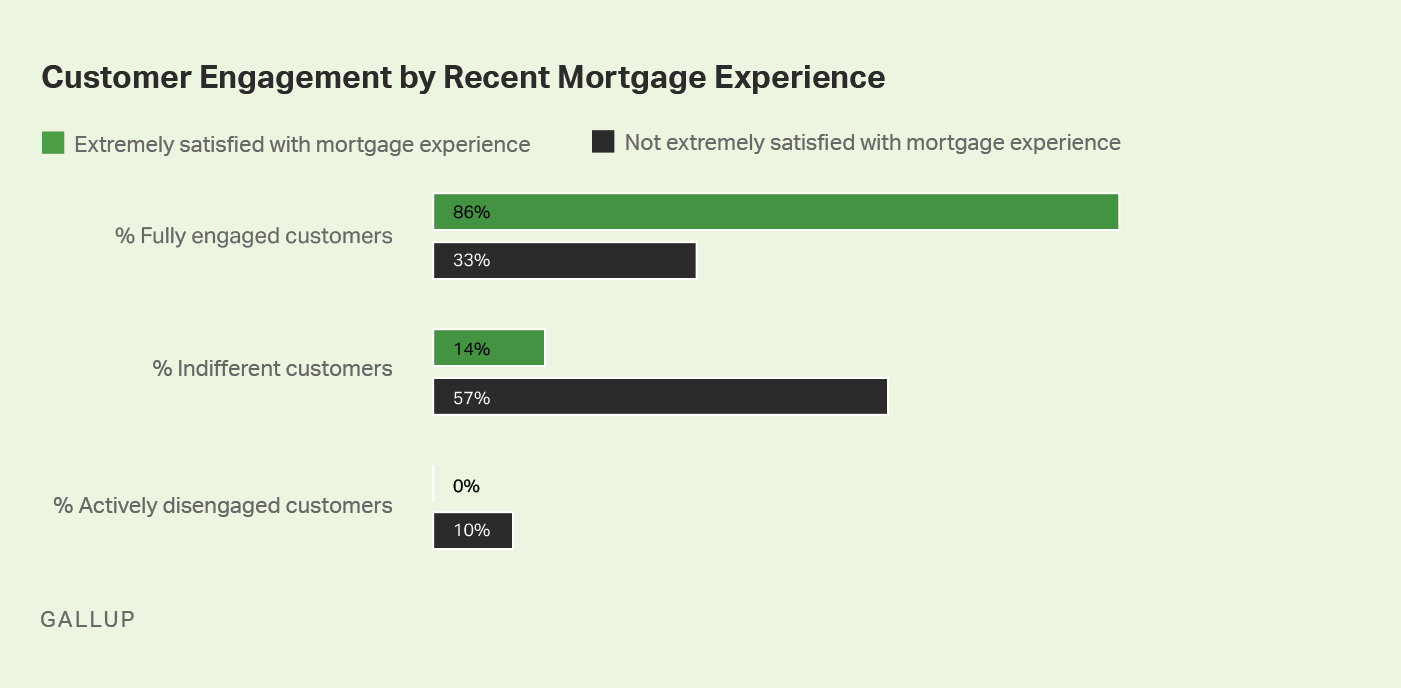

Gallup calls the customers who are in love with you "fully engaged." They are psychologically and emotionally committed to your brand, and they return a 23% premium in business outcomes -- including share of wallet -- compared with customers who are indifferent.

The mortgage process changes people: Customers walk away either completely in love with you -- or with complete disdain.

Gallup Analytics shows that nearly nine in 10 customers who are extremely satisfied with their mortgage experience are fully engaged with the company overall. They're in the top 1% of Gallup's customer engagement database for finance organizations.

But if the customer is anything less than extremely satisfied with their mortgage experience, the number who are fully engaged drops to just one in three -- the 21st percentile in Gallup's finance database.

In other words, one of the best ways to grow share of wallet -- or lose it -- is through the mortgage experience.

Customers don't care about your challenges.

Many mortgage lenders weren't excelling at providing an exceptional customer experience before the boom. Fewer than six in 10 customers feel extremely satisfied with their most recent mortgage experience, according to Gallup's database. Put bluntly, most mortgage companies think they're pretty good at creating an exceptional customer experience when they're actually pretty terrible -- and that's during "normal" times.

But during times of high volume, delivering a consistently great end-to-end experience for every customer is usually the first thing to go. There is often a too-narrow focus on simply getting loan files to closing. Communication with borrowers (and agents) lags or dries up completely, problems mount, unclear or incorrect expectations abound, and closing dates are missed.

The reality is that customers don't really care about your challenges. They still demand an outstanding end-to-end experience and will vote with their wallet -- perhaps for the rest of their lives, whether it's wealth management, deposit accounts, credit cards, auto loans or future mortgages.

One of the best ways to grow share of wallet -- or lose it -- is through the mortgage experience.

Sacrificing the customer experience is a shortsighted trade-off.

It's bad for current mortgage business, too. When the flood of loans hits, it is not uncommon to see the rate of exceptional customer experiences plummet by 10 points or more. That is, if you were average before, now fewer than half of customers are likely to have a great experience.

Delivering your worst service when you're in front of the most customers is a massive missed opportunity. And it can be avoided. Here's how:

-

Hit the customer's desired closing date. You should set realistic timing expectations with the borrower, but once the closing date is set, you need to hit it. Sixty-one percent of customers say they are extremely satisfied with their mortgage experience when their desired closing date was met -- compared with 19% when it was missed.

-

Employees must be experts. When loan officers and processors are experts on products, procedures and policies -- essentially, all aspects of the process -- customers are over 26 times more likely to say they are extremely satisfied with their overall mortgage experience.

-

Make it easy; don't waste their time. Customers are busy too. Make every experience and connection point -- digital or human -- extremely accessible and an efficient use of their time. If you do, your customers will be over 17 times more likely to say they are extremely satisfied with their mortgage experience.

-

Educate customers on the process. You do this work all day, every day. Your customers don't. Help them understand what's coming next -- along with the "why" and "when" -- and what will be expected of them at that time. It increases the odds by 15 times that your customer will be extremely satisfied with their experience.

Case Study: Premier Brand Improves Experience and Efficiency Through Talent

A national lender improved from an industry-worst experience to industry-best in two years by focusing on hiring A-level talent and reengineering their employee and customer experiences. They also shortened cycle times by eight days for purchase loans and 19 days for refinances, while cutting the cost per loan in half.

Trap 2: Staffing up with mediocre talent.

Increasing origination presence (digital and loan officers) and increasing fulfillment capacity to meet growing demand is complex. Whether you hire experienced talent, take a "grow your own" approach, contract with a third party or apply a combination of those strategies, filling seats with "good enough" talent instead of building the bench with A-level talent is a trap. A common one.

Gallup finds that organizations only hire A-level individual contributor talent for about three in 10 hires -- meaning that approximately 70% of hires have mediocre or low talent. It's even worse for managers -- only one in five managerial hires or promotions are A-level talent. Hiring lower-tier talent has massive ramifications for productivity, profitability, quality, customer experience and retention in both the short and long term.

But it doesn't have to be that way. You don't have to sacrifice long-term performance to meet today's demand. You can, and should, strive to hire at least 80% A-level talent -- experienced or inexperienced -- to deliver results today and in the years to come.

Without predictive talent assessments, mortgage companies will likely hire non-A talent approximately 70% of the time.

Gallup has developed predictive talent assessments that can identify A-level talent for all mortgage roles and channels (e.g., retail, consumer direct, wholesale, servicing) -- especially critical when volume is high and experienced job candidates are scarce.

First, A-level talent is attracted to specific recruiting messages -- what and how you communicate should cut through the noise and resonate with your high-talent prospects. Second, top talent onboards and ramps up much more quickly than their lower-talent counterparts. Gallup regularly sees inexperienced A-level talent quickly matching or exceeding their lower-talent, experienced peers in production, productivity and customer experience. Homing in on A-level talent makes a "grow-your-own" strategy more viable during this time.

Case Study: Lender Gains Market Share Through Talent

A U.S. mortgage company grew from a top 40 lender to a top five lender with a focused strategy of hiring A-level talent. They found that loan officers with A-level talent had 23% greater dollars funded compared with officers with lesser-level talent. And the effect multiplied when A-level talent loan officers were paired with A-level managers: They achieved an additional lift of 54% in dollars funded compared with A-level talent loan officers paired with non-A-level managers.

Making excellence the norm requires courageous leadership.

No leader disagrees that delivering exceptional customer experiences and hiring and promoting A-level talent is a winning strategy. So why is it so uncommon?

It's uncommon because many leaders tend to think with a scarcity mindset -- that it's not possible to handle the volume without sacrificing a bit of the customer experience. They tend to believe that finding enough A-level talent in a hot market is an unachievable dream. But these are false assumptions that threaten customer relationships and justify mediocrity.

The reality is that customers don't really care about your challenges. They still demand an outstanding end-to-end experience and will vote with their wallet -- perhaps for the rest of their lives.

Courageous leaders know that these are complementary approaches. They know that it's not just possible to excel in both areas when the stakes are high -- it's critical. For example:

- Leading with talent assessments pinpoints which candidates you should or shouldn't spend your time with -- helping you hire and onboard more quickly to achieve sustainable high performance.

- Identifying and removing barriers with people, products or processes that bog down loan turn times increases productivity and creates customers who walk away in love with your brand.

Building a high-performance mortgage business does take courage -- and commitment. Mortgage leaders must demand excellence all the time, not just when it's convenient. They must insist on building a better organization every day. Putting it off until the volume decreases undermines their future.

Today's refinance boom is a windfall for most mortgage companies. But courageous leaders -- from the C-suite down -- win more than their company's expected share because they avoid these two traps. And those who succeed under pressure now will still be winning when the boom is over.

Put high performance at the center of your strategy:

- Don't settle for mediocre talent -- stack the bench with A-level talent.

- Use Gallup's analytics and advice to navigate evolving customer expectations and drive organic growth.

- Focus on engagement and see returns in improved business outcomes.