Story Highlights

- Credit union members are getting hit harder than the average American

- Members need more financial wellbeing support than ever before

- Gallup recommends organizing member-related activities around three needs

Gallup recently initiated a study among its Credit Union Consortium participants -- representative of 3.2 million credit union members across the U.S. -- to better understand how members have been affected by the COVID-19 outbreak and exactly what kind of support they need most.

Credit Union Members Are Suffering More

Due to the economic impact of the pandemic, supporting members' financial wellbeing has become the central issue for credit unions. Gallup finds that credit union members are getting hit harder than the average American -- 76% say they have experienced a great deal or fair amount of disruption, compared with the national average of 70% recorded in mid-March.

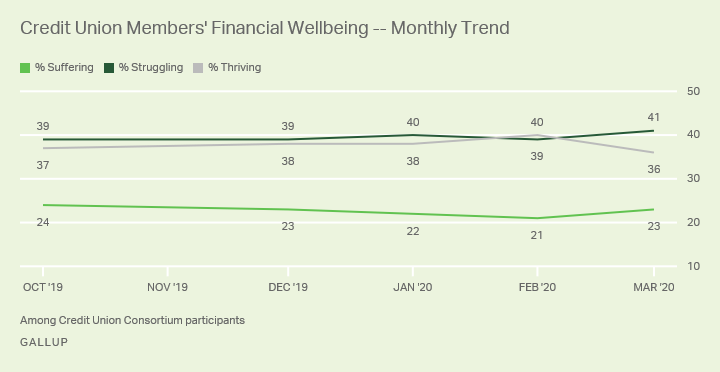

Gallup defines financial wellbeing as "managing one's economic life to reduce stress and increase security" -- in short, one's emotional relationship with money, which paints a truer picture of hope and worry than traditional financial health metrics do. A Gallup analysis of Consortium participant data shows that financial wellbeing is deteriorating: The percentage considered "thriving" is decreasing, while the percentages considered "struggling" and "suffering" are growing.

This is probably just the beginning. A March 20-22 Gallup poll shows that 61% of Americans expect a recession and 52% say it's very or somewhat likely their household will experience "major financial struggles" because of the pandemic.

Members Need More Support

As levels of suffering and struggling rise, so must credit unions' support. However, Gallup finds that those who are experiencing the most disruption from COVID-19 are also the least likely to say their credit union is looking out for their financial wellbeing.

| Credit union looks out for my financial wellbeing: Strongly agree | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| % | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Experiencing a great deal of disruption | 21 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Not experiencing disruption at all | 32 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Among Credit Union Consortium participants | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gallup, March 17-23, 2020 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

This can have significant ramifications on post-pandemic loyalty and market differentiation. Gallup research continually finds that what members want most from their credit union is support of their financial wellbeing. That feeling influences their engagement more than anything else we've measured. When members strongly agree that their credit union looks out for their financial wellbeing, 89% are fully engaged -- compared with 28% fully engaged among those who do not agree.

Do These Three Things

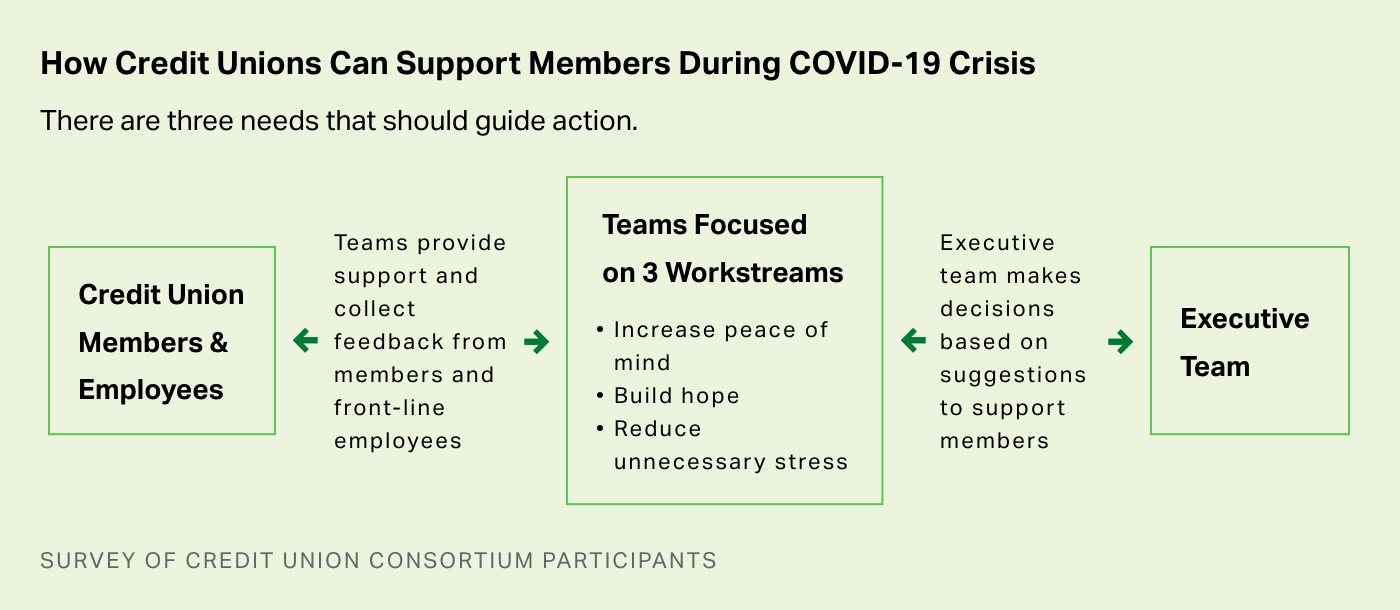

Three specific needs emerged when Gallup asked Consortium participants, "In what way can your credit union support you and your family during this situation?"

- Increase my peace of mind. Provide me with the relief I need to get through this crisis.

- Build my hope. Continually be there for me through guidance and solutions.

- Reduce my unnecessary stress. Make it easy for me to access staff and tools when and how I need them.

These three things are what members need most from their credit union right now, and thereby serve as a framework for providing exceptional service during this crisis and beyond. Gallup recommends that credit unions formally organize all COVID-19 member continuity planning around these urgent needs.

The exact implementation is less important than ensuring that (1) you recognize the workstream distinctions among all three, (2) you assess gaps and solutions for all three, and (3) you get a continuous stream of member input and feedback to evaluate all three.

Most credit unions need only to continue their current approach but organize it with greater distinction. Still, we urge credit unions to think about differentiation -- the new and unique ways to serve members' three financial wellbeing needs better. The time it takes to do so will be time well spent. Credit union members may need it for some time to come.

Get the support you need to support your members:

- Learn more about Callahan & Associates and Gallup's collaborative initiative to drive credit union member engagement.

- Use Gallup's analytics and advice to navigate evolving customer expectations and behaviors.

- Explore other resources for leading through COVID-19 disruption.