Story Highlights

- Millennials are least likely to visit a branch, but most likely to use mobile and online banking

- In-person experiences produce the most customer engagement

- Mobile banking apps must be as good as the best-designed apps overall

Missed the first article in this two-part series? Read it here.

Millennial customers are first-generation digital natives. In our recent banking study, millennials were the most likely generation to use both online (92%) and mobile (79%) channels -- and they tend to use those channels more frequently than older generations.

In contrast, only 66% of millennials visited a brick-and-mortar bank branch in the past six months, compared with 81% of baby boomers and 80% of traditionalists.

This presents a big challenge for banks, given that in-person branch and drive-thru experiences produce the largest gains in customer engagement.

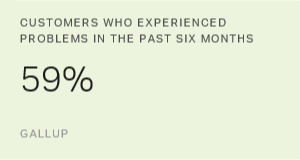

It is, therefore, not surprising that millennials (a) have more problems with their primary bank, (b) have the worst levels of customer engagement with their primary bank, and (c) leave their primary banks in larger numbers.

Additionally, banks are not having the needed "big conversations" with millennial customers. Less than a quarter (24%) of millennial banking customers strongly agree that their primary bank "helps me reach my financial goals." Even worse, a similar amount (26%) strongly agree that their bank meets the basic need of "looks out for my financial well-being."

So how can banks engage millennial customers when they are least likely to have a personal relationship with their bank?

1. Consider face-to-face interactions sacred.

The shift to digital banking does not mean the death of brick-and-mortar banks, but rather the increased stakes of face-to-face customer experiences.

Conversations are shifting from simple to complex -- from deposits, withdrawals, and balance statements to paying off student loans and credit cards, saving for a home and retirement, and the cost/benefits of home rental versus ownership.

Therefore, it is critical that the representatives in your bank are talented, engaged and reflect the level of banking expertise customers seek when they come into your branch.

If your millennial customers aren't having the big conversations with your associates, they will be looking to have them somewhere else.

2. The future remains digital.

Banking leaders have long understood that their future is primarily digital.

As opposed to older generations, who may need the bank to help bridge the digital transition, millennials already expect and prefer a seamless digital experience.

Banks should work to not only optimize their current online and mobile channels, but also to expand upon them to include services that are specifically positioned to assist with millennials' financial goals -- such as budgeting apps, bill-pay options and peer-lending platforms.

Additionally, advanced data analytics can provide a more precise customer segmentation to understand customer needs and financial well-being and then align that information with their digital interactions and user expectations.

3. Omnichannel alignment matters.

In an omnichannel banking world, banks are evaluated not by their best banking channel, but rather the consistency of all channels and the alignment of channel functionality with customer expectations.

Put simply -- not only does every channel matter, but what customers can do with each channel is crucial. Customers don't want to feel pushed into performing certain banking transactions on specific channels.

As banking leaders navigate the migration to a universal banking system, it is important that they consider how their suite of services is synced with the customer expectations of a channel's functionality.

4. Apps must meet high expectations.

Millennials are first adopters of popular fintech platforms such as Venmo, Apple Pay, Samsung Pay and Zelle.

Therefore, they expect a seamless and well-designed digital platform and are prone to abandon mobile platforms with feeble functionality and inferior design.

Banking leaders must understand that they are not just competing against other banks in this digital space. Rather, customers are comparing their digital banking experiences with all their other online interactions.

Mobile banking platforms must be as good as the best app on a millennial's phone to win in this space.

Because customers often only know the digital experience of their primary bank, digital banking initiatives should consider their expanded competition with apps more broadly and not solely their typical banking segment competitors.

In the end, banks must adapt to the millennial generation by not just going digital or mobile, but by creating a well-designed fluid multichannel experience -- while also providing memorable, positive in-person experiences that take customer relationships to a deeper level.

- Learn how millennials are changing the economic landscape permanently in our free report.

- Engage your millennial banking customers to prevent losing them to your competitors.

- Learn how to improve business outcomes using customer engagement in our free report.