Break Through With a Culture of Customer Experience

Sustainable organic growth requires making a long-term commitment to customers. Customer expectations have heightened, and competitors have responded accordingly. Striving to achieve a culture of customer experience will keep your organization on track.

Customer Experience Is Having a Moment

Over the past decade, many financial services firms have positioned the customer experience (CX) as a means to enhance their brand promise and differentiate themselves from competitors.

Most organizations initially focus on preventing the downside of CX by fixing problems and easing friction for customers. These efforts to consistently meet customers' basic expectations generate productive returns initially, but eventually slow and plateau.

If CX is limited to "fixing problems," the firm is limited to intervening and improving CX only for the segment of customers who have problems -- a segment that will hopefully grow smaller over time if problems are addressed.

To that point, the percentage of overall problems customers experience at top-performing financial firms is 10% or less.

Problems can be managed with effort, but to drive an upside and find room for continued growth -- to break through the plateau -- firms must evolve beyond a singular focus on service and enable culture. Gallup calls this shift a desire to create a "culture of customer experience" (CCX).

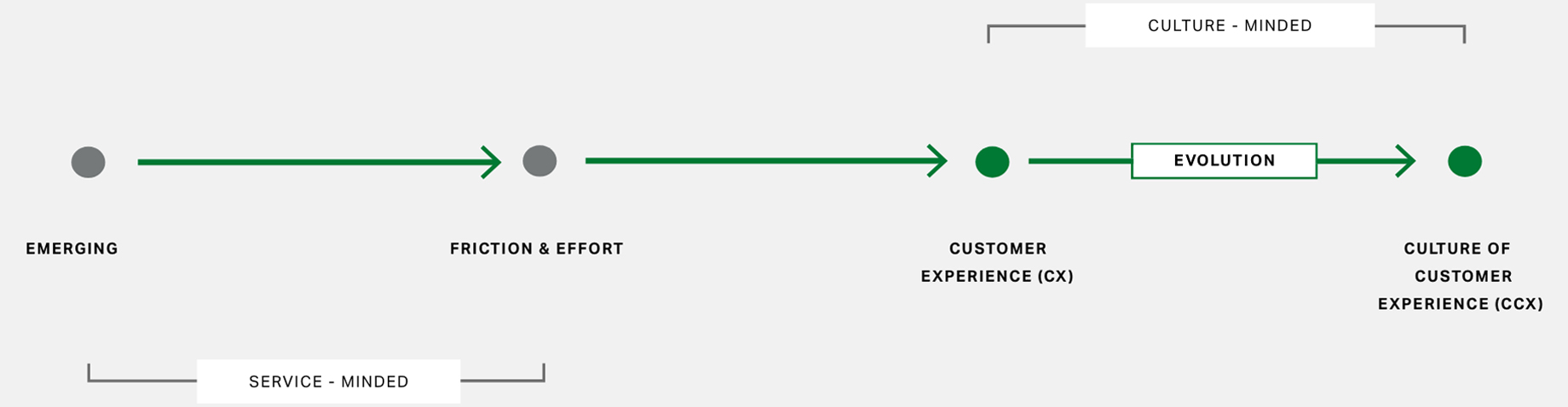

Organizations Must Bridge the Gap Between Being Service-Minded and Culture-Minded

The typical path an organization follows as it evolves from being service-minded to culture-minded:

Service-Minded

Emerging: Organizations at this stage of the journey to CCX are service-minded. They have some activities in place, but those activities lack meaningful impact. These organizations create basic frameworks, but they are not consistently applied -- leading to varying customer experiences.

Friction and Effort: Organizations at this stage of the journey to CCX are still classified as service-minded. They aim their strategy primarily at problem identification and reduction. The goal of "closing the loop" with discontented customers is emphasized.

Culture-Minded

Customer Experience (CX): Organizations at this stage of the journey to CCX are moving closer to being culture-minded. These organizations aim their strategy at a total view of the customer experience. Other traits of organizations at the CX stage of the journey include discipline for creating scaled listening, partnership with business lines using governance, and a focus on customer-facing roles.

Culture of Customer Experience (CCX): Organizations that achieve CCX are culture-minded. Their strategy is aimed at activating insights into cultural behaviors. They embed CX and EX expectations across all roles and align with technology, processes and policies. They focus on managing variation at the local level, and they develop unique signature experiences that support the brand promise.

A Shift in Perspective Can Unlock Growth

The ideal, aspirational state of CCX:

flourishing financial wellbeing

rationally and emotionally attached

higher financial performance

Reaching this ideal state, however, can be especially challenging for the financial services industry given the breadth and diverse nature of customer delivery channels. Most financial firms manage anywhere from 10 to 20 different touchpoints each day, which makes delivering a consistent CX through all of them more difficult than most other industries.

To navigate this and achieve CCX, Gallup recommends financial organizations use our banking growth trifecta:

- Customers have consistent and frictionless experiences across all channels.

- Customers adopt digital features and services.

- Customers receive high-quality conversations from human channels.

High Channel Consistency

Customers have consistent and frictionless experiences across all channels.

No matter how big a financial institution is, how many channels it offers customers or how many acquisitions it has made, that institution must deliver a consistent experience across every channel. If the experience isn't frictionless, customers will encounter problems. Keeping problem incidence at a manageable rate mitigates active disengagement among customers and protects customer relationships from deteriorating due to regularly experiencing problems.

High Digital Adoption

Customers adopt digital features and services.

The decade-plus shift in banking behavior to move everyday banking actions from human channels to digital ones is not just good for the customer, but also good for the bank, cost-wise. However, there's drastic variation between customers attempting digital offerings versus successfully adopting those digital offerings.

High-Quality Conversations

Customers receive high-quality conversations from human channels.

A high-quality conversation focuses on the customer as a person. These conversations can range from basic assistance to needs-based and future-focused support. Banks must consider the customer's financial vision for their future and must do so in a way that the customer feels the bank is "looking out for my financial wellbeing" -- and then replicate those conversational behaviors within key human channels at scale.

Navigate Five Achievement Horizons to Transform Your Organization and Drive Growth

True CCX is achieved and sustained through technology enablement combined with executive commitment, strategy, discipline, analytics and action. Organizations should work progressively and maturate their CX programs through five horizons:

-

Horizon 1Align through foundational listening and reporting. Establish a common language and begin building shared meaning with a collective sense of what is most important.

-

Horizon 2Improve effort, friction and problems. Focus on pain point identification, process, and issue resolution that hinders ease of doing business.

-

Horizon 3Broaden to an omnichannel view. Expand to multichannel listening by redesigning and recasting channel leader/manager roles, expectations, planning and metrics.

-

Horizon 4Transform local-level behaviors. Develop people operating discipline by integrating new listening, learning and action to the human factors.

-

Horizon 5Reinforce performance systems. Focus on congruency of performance management, incentives, recognition, etc. to continuously fortify the experience.

Organizations that can manage their customer experience against these three demands are going to be the winners across the board -- on NPS, on customer satisfaction and on emotional loyalty.

Discover how to improve sales effectiveness through conversations.

Contact us to learn more about how we can partner with you.