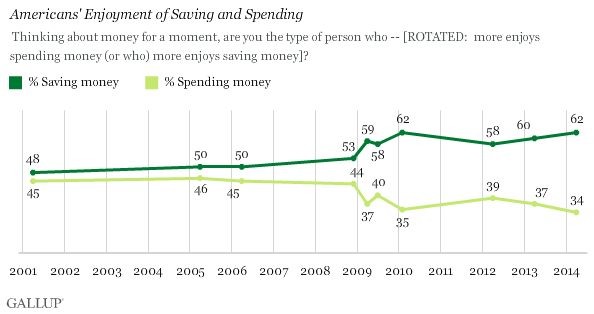

WASHINGTON, D.C. -- The majority of Americans continue to enjoy saving money more than spending it, by 62% to 34%. The 2014 saving-spending gap is the one of the widest since Gallup began tracking Americans' preferences in 2001.

These results are from Gallup's April 3-6 Economy and Personal Finance poll.

It may be surprising that the gap between self-reported enjoyment of saving and enjoyment is as wide as it is in 2014, considering the recent signs of positive momentum in the U.S. economy. Prior to the Great Recession, the saving-spending enjoyment gap was much smaller than it is now. After the onset of the economic downturn, the divergence widened considerably over the next couple of years, including 2010, when the gap stretched as wide as 27 percentage points. But then there was a short-lived narrowing of the gap to 19 points in 2012 before it increased again in 2013 and 2014.

While this question does not measure actual spending or saving, it provides important insight into the psychology of the American consumer's approach to money. At this point, the trend suggests that Americans have shifted their mindset significantly more toward the view that saving is the more enjoyable behavior, not spending.

Region and Income Linked With Saving vs. Spending

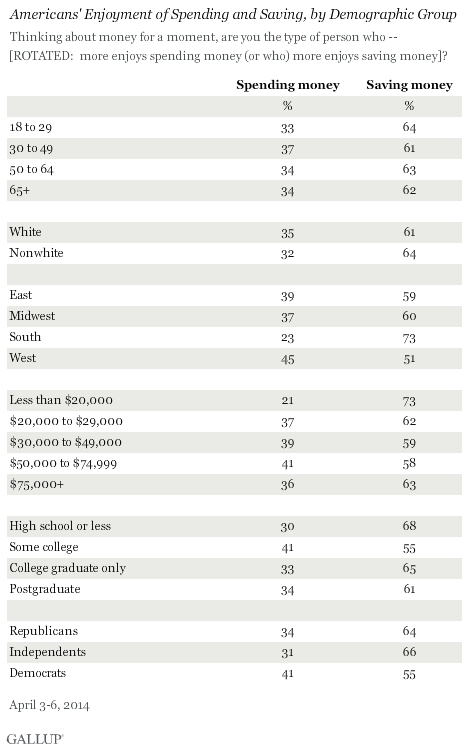

Americans' views vary little across the standard demographic segments of the U.S. population such as age, race, education, and political party.

But there are noticeable differences in saving versus spending preferences by region. The South has the largest tilt toward "saving" over "spending" -- by 73% to 23%. The West has the smallest disparity, with only 51% favoring saving to 45% spending.

There are also significant differences by household income level, with those in the lowest income category (earning less than $20,000 a year) more than three times as likely to favor saving (73%) over spending (21%). The gap narrows to 63% to 36% among the highest income bracket (earning $75,000 or more per year).

Views on Spending vs. Saving, by Financial Outlook Groups

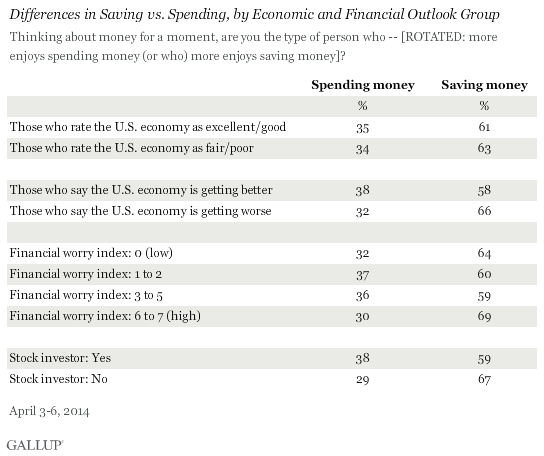

There is a sizable gap in self-reported enjoyment of spending and saving between stock market investors and non-investors, with self-identified investors more likely than non-investors to report enjoying spending, 38% versus 29%, respectively.

But for the most part, Americans' preferences for spending or saving do not tend to be linked to their views of the U.S. economy or to the severity of their financial worries. Americans who are more optimistic about the U.S. economy show little difference in enjoyment of spending or saving compared with Americans who are more negative.

There is also remarkably little difference in these self-reports based on worry about financial problems. Those who are most worried about finances are only slightly more likely to say they enjoy saving than those who are least worried.

Implications

The majority of Americans continue to report enjoying saving more than spending. However, this trend is not necessarily indicative of actual behavior. While the number of Americans to report greater enjoyment of saving has been increasing in recent years, so has personal consumption. Although Americans, since 2009, have been significantly more likely to enjoy saving, or perhaps more likely to feel guilty about spending, their views have not been evident in their real-world behavior.

This disconnection between desired state and actual behavior could have significant implications.

On a macro level, economists would typically view increases in personal consumption as a positive sign of an improving economy. But if the increases in spending are occurring out of necessity, not desire, and Americans take on more debt or deplete their savings, the picture may not be quite as rosy. Data from the U.S. Department of Commerce show that the 2013 average personal savings rate was 4.5%, the lowest since 2007 and low historically. The U.S. average personal savings rate in the 1970s was 11.8%, 9.3% in the 1980s, and 6.7% in the 1990s.

Stagnant wage growth and the overall sluggish recovery from the Great Recession perhaps have contributed to decreasing personal savings. While Gallup data indicate a stronger preference to save than to spend, in reality Americans seem to be having difficulty putting together a safety net. This has more than likely contributed to the lingering pessimism about the U.S. economy.

Survey Methods

Results for this Gallup poll are based on telephone interviews conducted April 3-6, 2014, with a random sample of 1,026 adults, aged 18 and older, living in all 50 U.S. states and the District of Columbia.

For results based on the total sample of national adults, the margin of sampling error is ±5 percentage points at the 95% confidence level.

Interviews are conducted with respondents on landline telephones and cellular phones, with interviews conducted in Spanish for respondents who are primarily Spanish-speaking. Each sample of national adults includes a minimum quota of 50% cellphone respondents and 50% landline respondents, with additional minimum quotas by time zone within region. Landline and cellular telephone numbers are selected using random-digit-dial methods. Landline respondents are chosen at random within each household on the basis of which member had the most recent birthday.

Samples are weighted to correct for unequal selection probability, nonresponse, and double coverage of landline and cell users in the two sampling frames. They are also weighted to match the national demographics of gender, age, race, Hispanic ethnicity, education, region, population density, and phone status (cellphone only/landline only/both, and cellphone mostly). Demographic weighting targets are based on the most recent Current Population Survey figures for the aged 18 and older U.S. population. Phone status targets are based on the most recent National Health Interview Survey. Population density targets are based on the most recent U.S. census. All reported margins of sampling error include the computed design effects for weighting.

In addition to sampling error, question wording and practical difficulties in conducting surveys can introduce error or bias into the findings of public opinion polls.

View survey methodology, complete question responses, and trends.

For more details on Gallup's polling methodology, visit www.gallup.com.