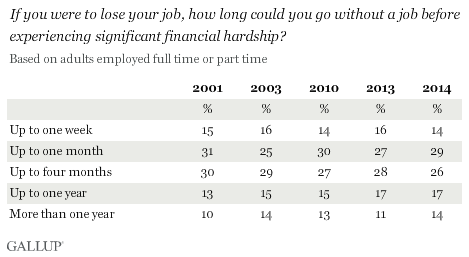

PRINCETON, NJ -- Many working Americans would experience financial peril if they lost their current job, putting pressure on them to find a new job quickly. A substantial minority of U.S. workers say they could go just one week (14%) or one month (29%) before experiencing significant financial hardship if they lost their job.

Gallup's annual Economy and Personal Finance poll, conducted April 3-6, finds 26% of workers saying they could go without a job for up to four months, while about one-third of workers could get by for up to a year or more.

These perceptions have been fairly stable over time, including before the recent economic downturn.

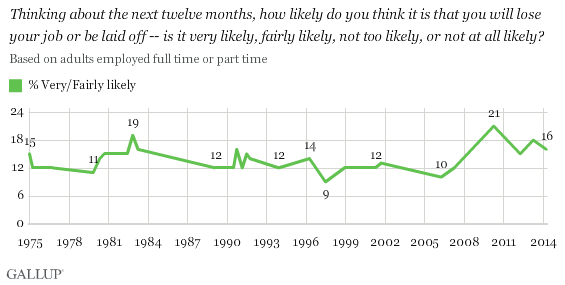

One reason many American workers may not be prepared financially for a job loss is they think it is unlikely to happen to them. Sixteen percent of workers say they are "very" (5%) or "fairly" (11%) likely to lose their job in the next 12 months. That percentage is down from a peak of 21% in 2010, a year of high unemployment, but has averaged 14% since Gallup first asked the question in 1975.

The vast majority of U.S. workers currently say it is either "not too likely" (34%) or "not at all likely" (50%) they will lose their job in the next 12 months.

Nine Percent of Workers on Financial Brink

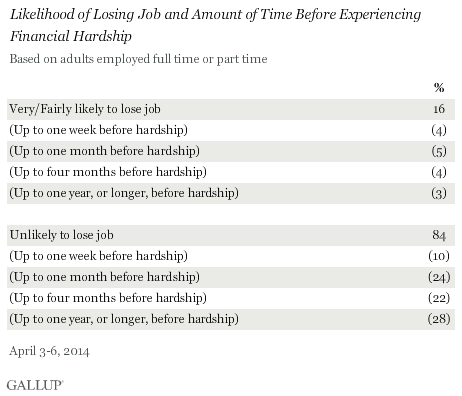

An analysis of these two job-loss questions in combination finds 9% of all U.S. workers highly vulnerable to a job loss -- saying it is very or fairly likely they will lose their job and that they could go up to a week (4%) or a month (5%) without a job before experiencing financial hardship.

That combined 9% figure represents a majority of the 16% who think it is likely they will lose their job. Thus, of those who think their job is in jeopardy, most say they will be able to financially survive joblessness for just weeks without finding a new job.

In contrast, of those who think it is unlikely they will lose their job, many more could go longer before experiencing hardship. Half of all U.S. workers think it is unlikely they will lose their job, but say they could go up to four months or longer before their finances suffered if this happened. That compares with 34% of workers who do not expect to lose their job and could go a month or less. Thus, disproportionately more workers who do not feel their job is threatened say they could endure an extended layoff than say they could not.

Lower-Income, Younger Workers More Vulnerable to Extended Unemployment

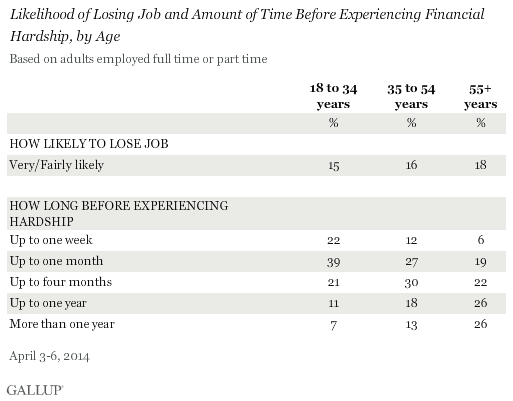

Younger and older workers do not differ in their perceptions that their job is at risk; however, younger workers say they would be subject to financial hardship much more quickly than older workers if they did lose their job. Six in 10 workers younger than 35 could go only one month or less before experiencing hardship, compared with 39% of workers aged 35 to 54 and 25% of workers aged 55 and older. That difference may be attributable to older workers' having had more years to build up savings.

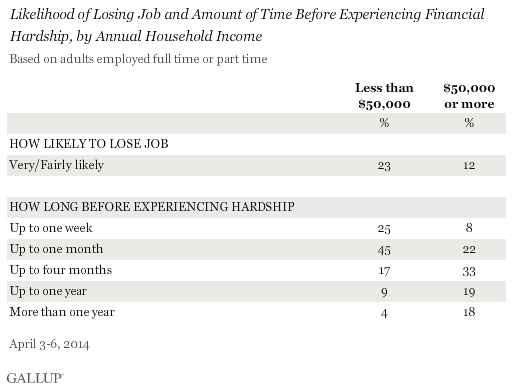

As would be expected, lower-income workers, those whose annual household incomes are less than $50,000, could get by for a shorter amount of time than higher-income workers if they lost their job. Seven in 10 lower-income workers could last a month or less before experiencing hardship, compared with 30% of higher-income workers. Lower-income workers are also twice as likely as higher-income workers to believe they are vulnerable to losing their job.

Implications

With long-term unemployment a serious problem in recent years, many U.S. workers are not in a position financially to go a month, or even a week, without finding a new job if laid off. That underscores the economic hardship that unemployment of any length can bring on U.S. families, particularly for younger and lower-income workers.

Relatively few workers expect to get laid off, which is probably an accurate reflection of their job security because even in times of high unemployment, at least 90% of Americans in the workforce are employed. Still, layoffs are an economic reality, and many workers who lose their job do not see it coming. Gallup estimates that about 9% of workers are especially vulnerable, in that they think it is at least fairly likely they will be laid off but do not have the financial means to go more than a month without finding new employment.

Survey Methods

Results for this Gallup poll are based on telephone interviews conducted April 3-6, 2014, with a random sample of 509 adults employed full or part time, aged 18 and older, living in all 50 U.S. states and the District of Columbia.

For results based on the total sample of workers, the margin of sampling error is ±5 percentage points at the 95% confidence level.

Interviews are conducted with respondents on landline telephones and cellular phones, with interviews conducted in Spanish for respondents who are primarily Spanish-speaking. Each sample of national adults includes a minimum quota of 50% cellphone respondents and 50% landline respondents, with additional minimum quotas by time zone within region. Landline and cellular telephone numbers are selected using random-digit-dial methods. Landline respondents are chosen at random within each household on the basis of which member had the most recent birthday.

Samples are weighted to correct for unequal selection probability, nonresponse, and double coverage of landline and cell users in the two sampling frames. They are also weighted to match the national demographics of gender, age, race, Hispanic ethnicity, education, region, population density, and phone status (cellphone only/landline only/both, and cellphone mostly). Demographic weighting targets are based on the most recent Current Population Survey figures for the aged 18 and older U.S. population. Phone status targets are based on the most recent National Health Interview Survey. Population density targets are based on the most recent U.S. census. All reported margins of sampling error include the computed design effects for weighting.

In addition to sampling error, question wording and practical difficulties in conducting surveys can introduce error or bias into the findings of public opinion polls.

View survey methodology, complete question responses, and trends.

For more details on Gallup's polling methodology, visit www.gallup.com.