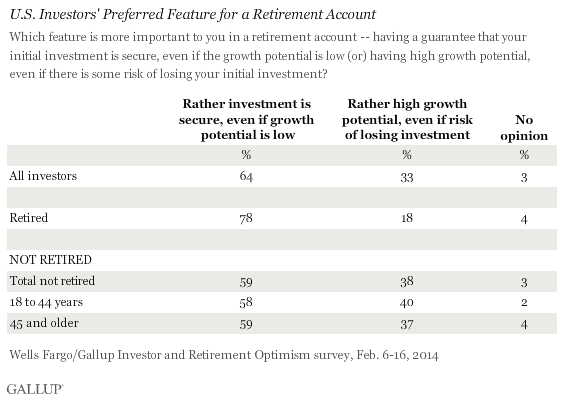

PRINCETON, NJ -- U.S. investors are generally a cautious group when thinking about the risk versus return options for their retirement savings. Nearly two-thirds of investors, in the latest Wells Fargo/Gallup Investor and Retirement Optimism survey, say having a guarantee that their initial investment is secure, even if it means the growth potential is low, is more important to them than having high growth potential that carries some risk of losing their initial investment.

More specifically, when asked to choose, 64% of investors favor the no-risk/low-return option, while 33% opt for the risk/high-return option. In practice, investors often use both strategies by diversifying their investments across multiple risk levels. But the survey responses broadly indicate that the majority of U.S. investors are not comfortable with financial risk.

Such caution is typically warranted for retirees, and accordingly, 78% of retired investors surveyed prefer the no-risk option. However, the majority of investors who are not yet retired (59%) also lean in this direction. Additionally, there is no difference in risk tolerance between older and younger nonretirees. Even 58% of those aged 18 to 44, who have more time to weather bear markets and lost principal, prefer low-risk investing.

The Wells Fargo/Gallup Investor and Retirement Optimism survey is based on U.S. investors with $10,000 or more in stocks, bonds, mutual funds, self-directed IRAs, and 401(k)s. The current results are based on interviews conducted Feb. 6-16 with 1,011 investors, including 358 retirees and 650 nonretirees.

Large Investors, Men Most Risk-Tolerant

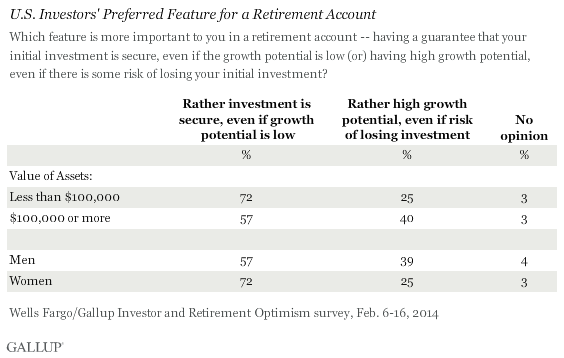

Investors with $100,000 or more in invested assets are somewhat more willing than those with smaller portfolios to accept the risks that come with high growth potential (40% vs. 25%); however, the majority of both groups (57% and 72%) still lean in the direction of favoring no risk.

Investment psychology also differs somewhat by gender, with male investors showing greater tolerance for risk than female investors. But again, the majority of both groups -- 57% of men and 72% of women -- say that having a guarantee that their principal is secure trumps having high growth potential.

Implications

Risk is integral to investing, and taking on risk that theoretically jeopardizes your initial investment -- such as investing in stocks -- is often the only way to realize the kind of growth Americans need to save for retirement. At the very least, investors need to take on risk to ensure their savings keep up with inflation, which is the reduction of purchasing power over time.

But risk sounds, well, risky. And that may be exactly why President Barack Obama has proposed a new retirement savings instrument, called "MyRA" that is backed by the U.S. Treasury and promises, in Obama's words "no risk of losing what you put in." The plan also comes with no fees and is portable across jobs. The government bonds that will constitute MyRA accounts have historically not kept up with inflation, making the financial value to consumers questionable. However, with a $15,000 limit on what workers can invest in MyRA before converting to a Roth IRA, the real virtue of the plans may not be in creating retirement security, but in starting a habit of investing in people who have yet to save anything. If -- as seen in the Wells Fargo/Gallup survey -- investors with $10,000 or more in investments say security on principal trumps high growth, then it is a safe bet that the workers targeted for inclusion in the MyRA program feel the same way.

Survey Methods

The Wells Fargo/Gallup Investor and Retirement Optimism Index results are based on questions asked on the Gallup Daily tracking survey of a random sample of 1,011 U.S. adults having investable assets of $10,000 or more Feb. 6-16, 2014.

For results based on the entiresample of national adults, the margin of sampling error is ±3 percentage points at the 95% confidence level.

Interviews are conducted with respondents on landline telephones and cellular phones, with interviews conducted in Spanish for respondents who are primarily Spanish-speaking. Each sample of national adults includes a minimum quota of 50% cellphone respondents and 50% landline respondents, with additional minimum quotas by time zone within region. Landline and cellular telephone numbers are selected using random-digit-dial methods. Landline respondents are chosen at random within each household on the basis of which member had the most recent birthday.

Samples are weighted to correct for unequal selection probability, nonresponse, and double coverage of landline and cell users in the two sampling frames. They are also weighted to match the national demographics of gender, age, race, Hispanic ethnicity, education, region, population density, and phone status (cellphone only/landline only/both, and cellphone mostly). Demographic weighting targets are based on the most recent Current Population Survey figures for the aged 18 and older U.S. population. Phone status targets are based on the most recent National Health Interview Survey. Population density targets are based on the most recent U.S. census. All reported margins of sampling error include the computed design effects for weighting.

In addition to sampling error, question wording and practical difficulties in conducting surveys can introduce error or bias into the findings of public opinion polls.

For more details on Gallup's polling methodology, visit www.gallup.com.