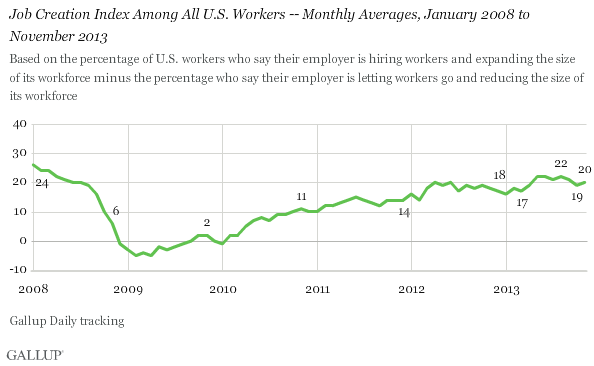

PRINCETON, NJ -- Gallup's Job Creation Index was relatively stable in November at +20, remaining in line with readings since April. At the same time, last month's score is the highest recorded in any November since Gallup began tracking this measure daily in 2008. The index remains much more positive now than during the 2008-2009 recession and its immediate aftermath.

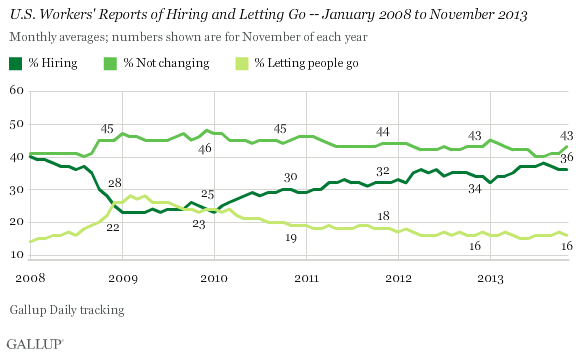

The index for November reflects the difference between the 36% of U.S. workers who say their employer is expanding its workforce and the 16% of workers whose employers are letting people go.

Forty-three percent say their employer is not changing the size of its workforce, a proportion that has remained relatively flat over the past few years.

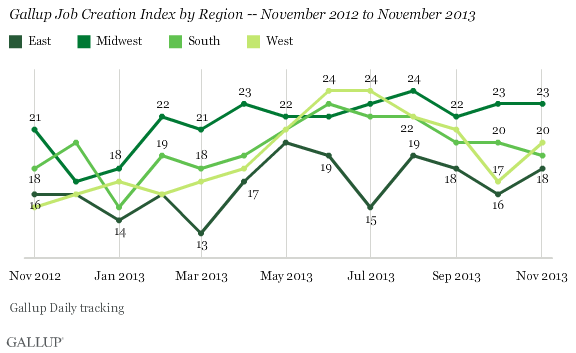

Midwest Still Leading the Nation in Job Creation

Employers in the Midwest continue to lead the way in job creation, with the Job Creation Index in this region standing in the low to mid-20s since February. The West saw a three-point increase in November, to +20 from +17, possibly reversing a downward trend between June and October. The index rose two points in the East, and now stands at +18.

The index in the South has dropped four points since June, though it remains higher than in the East, which has had the lowest scores for almost all of the past year.

Bottom Line

After falling slightly in October, the jobs situation in the U.S. showed little change in November, but it stands above levels from recent Novembers. Job creation remains higher than it was from late 2008 through early 2012, but has not yet rebounded to the pre-recession levels seen in early 2008. Job growth is happening at different paces across the country, with the rate in the Midwest remaining comparatively high, and job creation in the South sliding continuously since June.

Gallup.com reports results from these indexes in daily, weekly, and monthly averages and in Gallup.com stories. Complete trend data are always available to view and export in the following charts:

Daily: Employment, Economic Confidence, Job Creation, Consumer Spending

Weekly: Employment, Economic Confidence, Job Creation, Consumer Spending

Read more about Gallup's economic measures.

View our economic release schedule.

Survey Methods

Results for this Gallup poll are based on telephone interviews conducted Nov. 1-30, 2013, on the Gallup Daily tracking survey, with a random sample of 16,701 adults, aged 18 and older, who are employed full or part time, living in all 50 U.S. states and the District of Columbia.

For results based on the total sample of employed adults, the margin of sampling error is ±1 percentage point at the 95% confidence level.

Interviews are conducted with respondents on landline telephones and cellular phones, with interviews conducted in Spanish for respondents who are primarily Spanish-speaking. Each sample of national adults includes a minimum quota of 50% cellphone respondents and 50% landline respondents, with additional minimum quotas by region. Landline and cell telephone numbers are selected using random-digit-dial methods. Landline respondents are chosen at random within each household on the basis of which member had the most recent birthday.

Samples are weighted to correct for unequal selection probability, nonresponse, and double coverage of landline and cell users in the two sampling frames. They are also weighted to match the national demographics of gender, age, race, Hispanic ethnicity, education, region, population density, and phone status (cellphone only/landline only/both, and cellphone mostly). Demographic weighting targets are based on the March 2012 Current Population Survey figures for the aged 18 and older U.S. population. Phone status targets are based on the July-December 2011 National Health Interview Survey. Population density targets are based on the 2010 census. All reported margins of sampling error include the computed design effects for weighting.

In addition to sampling error, question wording and practical difficulties in conducting surveys can introduce error or bias into the findings of public opinion polls.

For more details on Gallup's polling methodology, visit www.gallup.com.